Elif Bulut

Elif Bulut

Elif Bulut

FINANCE MANAGMENT APP

FINANCE MANAGMENT APP

FINANCE MANAGMENT APP

FINANCE MANAGMENT APP

a shared budget and expense management app

a shared budget and expense management app

a shared budget and expense management app

a shared budget and expense management app

UX/UI Designer

UX/UI Designer

UX/UI Designer

Personal Project

Personal Project

Personal Project

2 weeks, 2025

2 weeks, 2025

2 weeks, 2025

Figma, Figjam, Miro, Framer, Adobe CC (Ps, Pr)

Figma, Figjam, Miro, Framer, Adobe CC (Ps, Pr)

Figma, Figjam, Miro, Framer, Adobe CC (Ps, Pr)

UX/UI Design, Case Study, Visulation, Brand Identity

UX/UI Design, Case Study, Visulation, Brand Identity

UX/UI Design, Case Study, Visulation, Brand Identity

An app that helps friends and families manage a shared budget and save for group goals like vacations or shared bills.

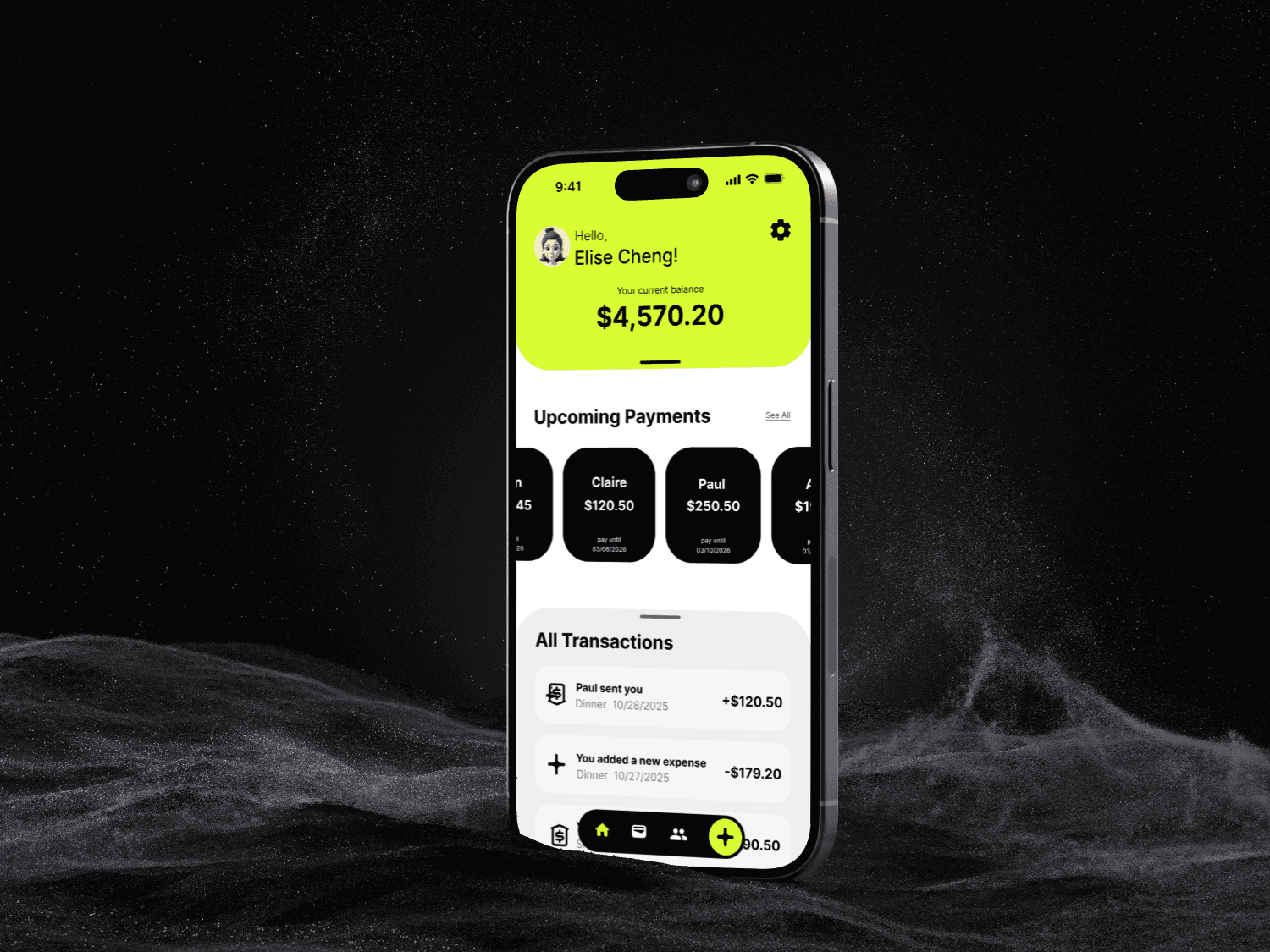

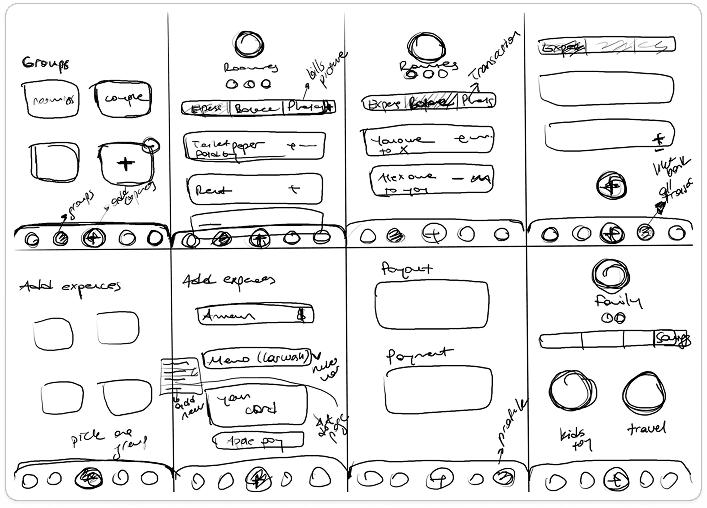

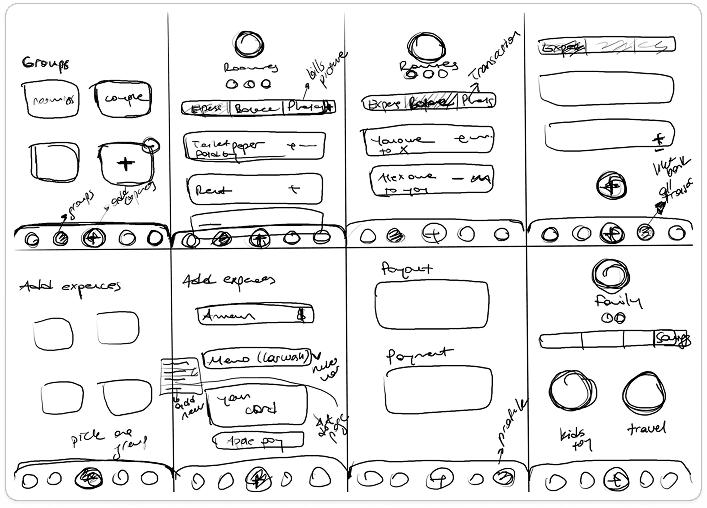

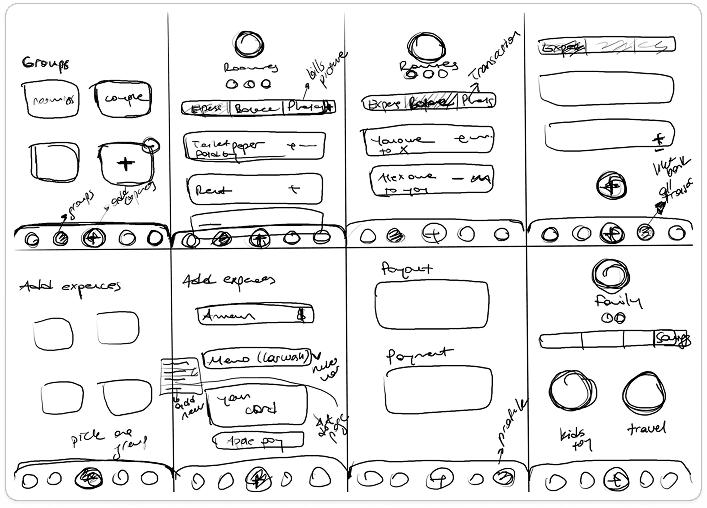

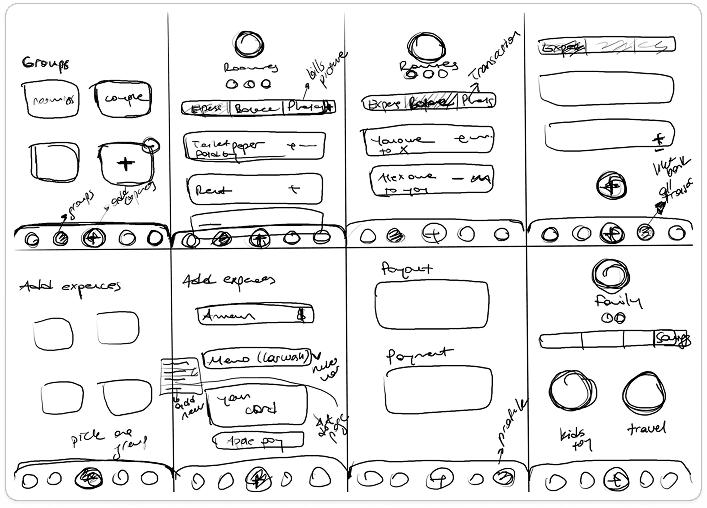

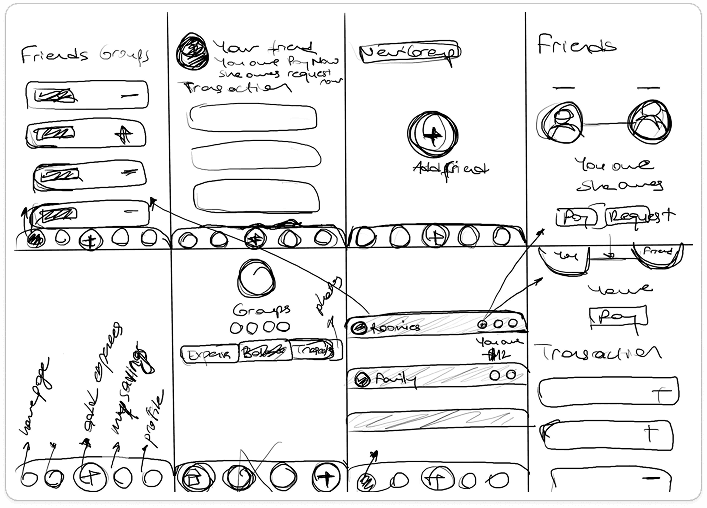

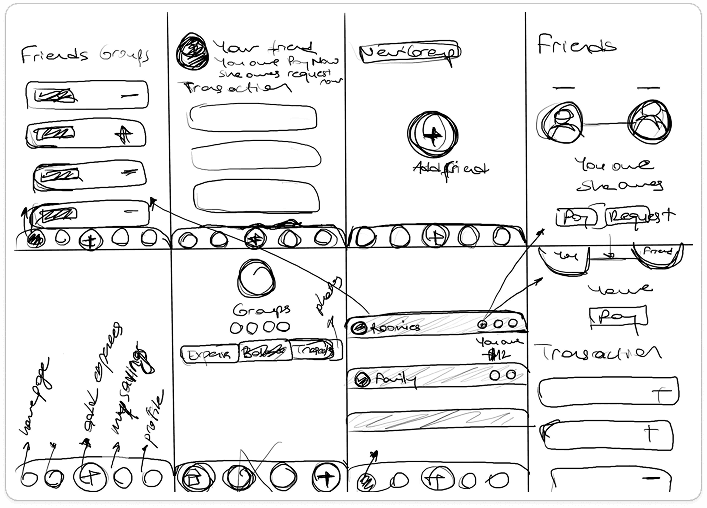

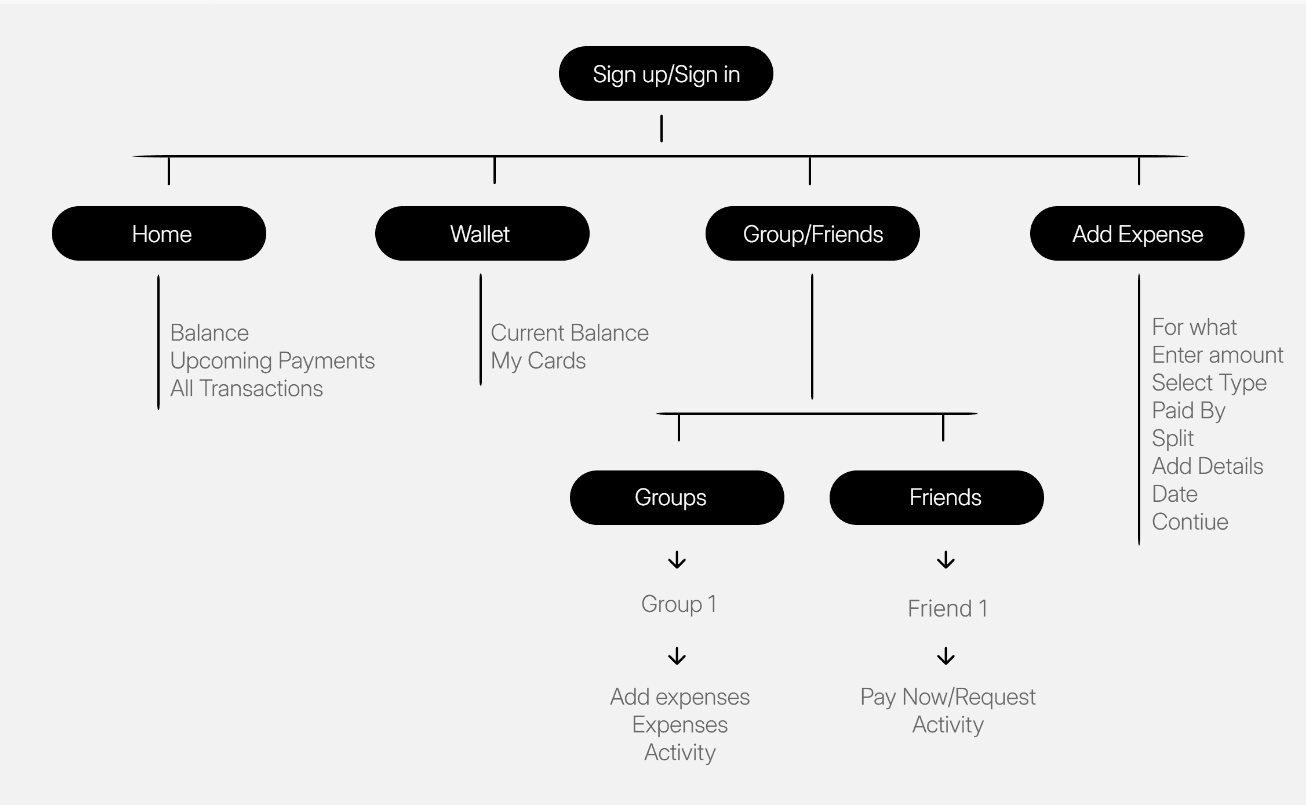

Managing shared finances within a group—whether it's roommates splitting rent, friends planning a trip, or family saving for a common goal—can often become chaotic and stressful. Inspired by this everyday problem, I designed a mobile app called Nest: a simple, intuitive, and collaborative platform that helps groups manage a shared budget and save together effectively. This case study walks through the full design process of Nest, from identifying the problem to delivering a functional, user-centered solution. You'll discover how I approached the challenge using design thinking principles—empathizing with users, defining clear pain points, ideating meaningful solutions, prototyping user flows, and testing for usability. The goal was not only to create a tool for managing money, but also to reduce financial friction in relationships by fostering trust, transparency, and teamwork.

An app that helps friends and families manage a shared budget and save for group goals like vacations or shared bills.

Managing shared finances within a group—whether it's roommates splitting rent, friends planning a trip, or family saving for a common goal—can often become chaotic and stressful. Inspired by this everyday problem, I designed a mobile app called Nest: a simple, intuitive, and collaborative platform that helps groups manage a shared budget and save together effectively. This case study walks through the full design process of Nest, from identifying the problem to delivering a functional, user-centered solution. You'll discover how I approached the challenge using design thinking principles—empathizing with users, defining clear pain points, ideating meaningful solutions, prototyping user flows, and testing for usability. The goal was not only to create a tool for managing money, but also to reduce financial friction in relationships by fostering trust, transparency, and teamwork.

“Let’s keep it fair — and fun.” — Mia

Mia is a freelance illustrator with a creative spirit and a laid-back approach to money. She’s not super strict with budgeting, but when she and her friends started planning a dream vacation, she realized how fast things can get messy. No one remembers who paid for what, and awkward convos are becoming common. Mia wants a light, friendly app that helps her and her friends stay organized, motivated, and clear on contributions — without making it feel like a boring finance class. For her, it needs to be visual, fun, and totally stress-free.

24 — Freelance Illustrator — Single, saving with friends — Portland, OR — Splitwise, Notes app

— I believe that by designing an interactive, goal-based savings feature with visual feedback, Mia will stay engaged and motivated to save with her friends.

“Let’s keep it fair — and fun.” — Mia

Mia is a freelance illustrator with a creative spirit and a laid-back approach to money. She’s not super strict with budgeting, but when she and her friends started planning a dream vacation, she realized how fast things can get messy. No one remembers who paid for what, and awkward convos are becoming common. Mia wants a light, friendly app that helps her and her friends stay organized, motivated, and clear on contributions — without making it feel like a boring finance class. For her, it needs to be visual, fun, and totally stress-free.

24 — Freelance Illustrator — Single, saving with friends — Portland, OR — Splitwise, Notes app

— I believe that by designing an interactive, goal-based savings feature with visual feedback, Mia will stay engaged and motivated to save with her friends.

“Let’s keep it fair — and fun.” — Mia

Mia is a freelance illustrator with a creative spirit and a laid-back approach to money. She’s not super strict with budgeting, but when she and her friends started planning a dream vacation, she realized how fast things can get messy. No one remembers who paid for what, and awkward convos are becoming common. Mia wants a light, friendly app that helps her and her friends stay organized, motivated, and clear on contributions — without making it feel like a boring finance class. For her, it needs to be visual, fun, and totally stress-free.

24 — Freelance Illustrator — Single, saving with friends — Portland, OR — Splitwise, Notes app

— I believe that by designing an interactive, goal-based savings feature with visual feedback, Mia will stay engaged and motivated to save with her friends.

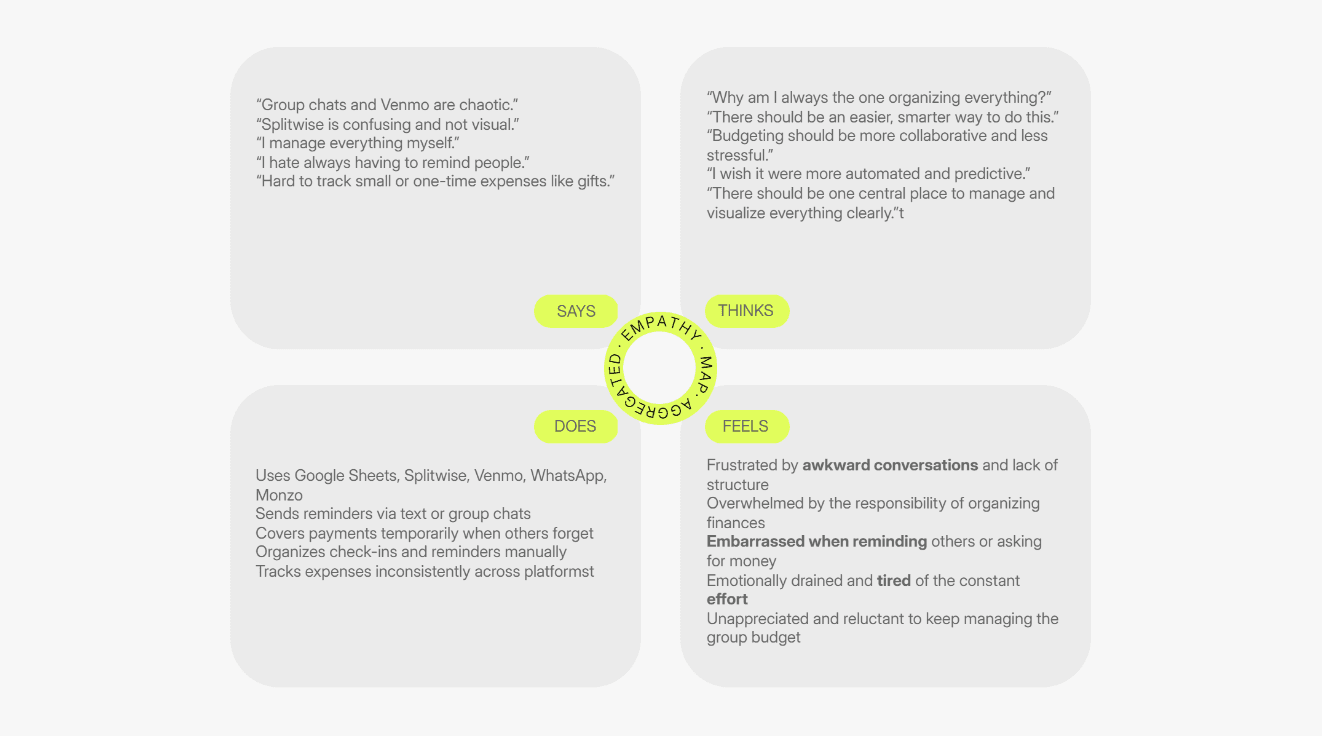

Manual Tracking is Time-Consuming and Inaccurate

Awkwardness in Talking About Money

Lack of Transparency in Shared Expenses

Difficulty Staying on Track Toward a Shared Goal

Unclear Roles and Responsibilities

— Users often feel unsure about who paid for what and whether everyone is contributing equally. This can lead to tension, misunderstandings, and even conflict.

Manual Tracking is Time-Consuming and Inaccurate

Awkwardness in Talking About Money

Lack of Transparency in Shared Expenses

Difficulty Staying on Track Toward a Shared Goal

Unclear Roles and Responsibilities

— Users often feel unsure about who paid for what and whether everyone is contributing equally. This can lead to tension, misunderstandings, and even conflict.

Manual Tracking is Time-Consuming and Inaccurate

Awkwardness in Talking About Money

Lack of Transparency in Shared Expenses

Difficulty Staying on Track Toward a Shared Goal

Unclear Roles and Responsibilities

— Users often feel unsure about who paid for what and whether everyone is contributing equally. This can lead to tension, misunderstandings, and even conflict.

HOW MIGHT WE..?

HOW MIGHT WE..?

HOW MIGHT WE..?

→ help groups manage shared expenses transparently to reduce confusion and financial tension?

→ help groups manage shared expenses transparently to reduce confusion and financial tension?

→ help groups manage shared expenses transparently to reduce confusion and financial tension?

HOW MIGHT WE..?

HOW MIGHT WE..?

→ motivate users to consistently contribute toward shared savings goals?

→ motivate users to consistently contribute toward shared savings goals?

HOW MIGHT WE..?

HOW MIGHT WE..?

→ simplify the experience of tracking and splitting expenses across different categories and group members?

→ simplify the experience of tracking and splitting expenses across different categories and group members?

HOW MIGHT WE..?

HOW MIGHT WE..?

→ create an inclusive budgeting tool that accommodates different levels of financial literacy?

→ create an inclusive budgeting tool that accommodates different levels of financial literacy?

HOW MIGHT WE..?

HOW MIGHT WE..?

→ celebrate small milestones to keep group members emotionally connected to their saving progress?

→ celebrate small milestones to keep group members emotionally connected to their saving progress?

Next Project

Next Project

Next Project

WAVE: sleep quality devices

smart sleep devices that uses brain waves and aim to improve sleep quality